In the early days of a business, the financial picture tends to be simple: revenue in, costs out, cash flow tight or stable. But once growth kicks in – new customers, products, perhaps markets – those simple statements no longer give enough clarity. Business intelligence (BI) becomes essential: the ability to turn financial and operational data into insight for decision-making. Outsourcing accounting is one under-utilized lever many companies can pull to sharpen BI with far less internal strain. Below is how it works, why it matters, and how to do it well.

Why better business intelligence matters

Before exploring how outsourcing helps, it’s worth clarifying what “better BI” actually delivers.

- Faster decision-making with confidence, rather than waiting weeks for reports that might already be outdated.

- Deeper visibility into profitability: by customer, by channel, by product line, even by marketing campaign.

- Proactive, not reactive management of cash flow, cost overruns, or under-performing segments.

- Forecasting & scenario planning: What if we hire more staff? What if a key client churns? What if revenue dips?

- Alignment across teams: when sales, operations, marketing, and finance look at the same numbers, strategy becomes more coherent.

Without accurate, timely, granular data, these insights are out of reach. And in many growing businesses, bookkeeping and in-house accounting are too busy handling daily tasks to produce clean, forward-looking intelligence.

How outsourced accounting strengthens business intelligence

Outsourcing accounting can unlock BI in several important ways. It’s not just about offloading tasks, it’s about elevating the insights coming from financials.

Expert systems and standardized processes

Providers bring polished systems for reconciliations, period closes, and reporting. These frameworks, honed across multiple clients, reduce errors and create consistency, which is critical for trustworthy data.

Access to specialized data tools

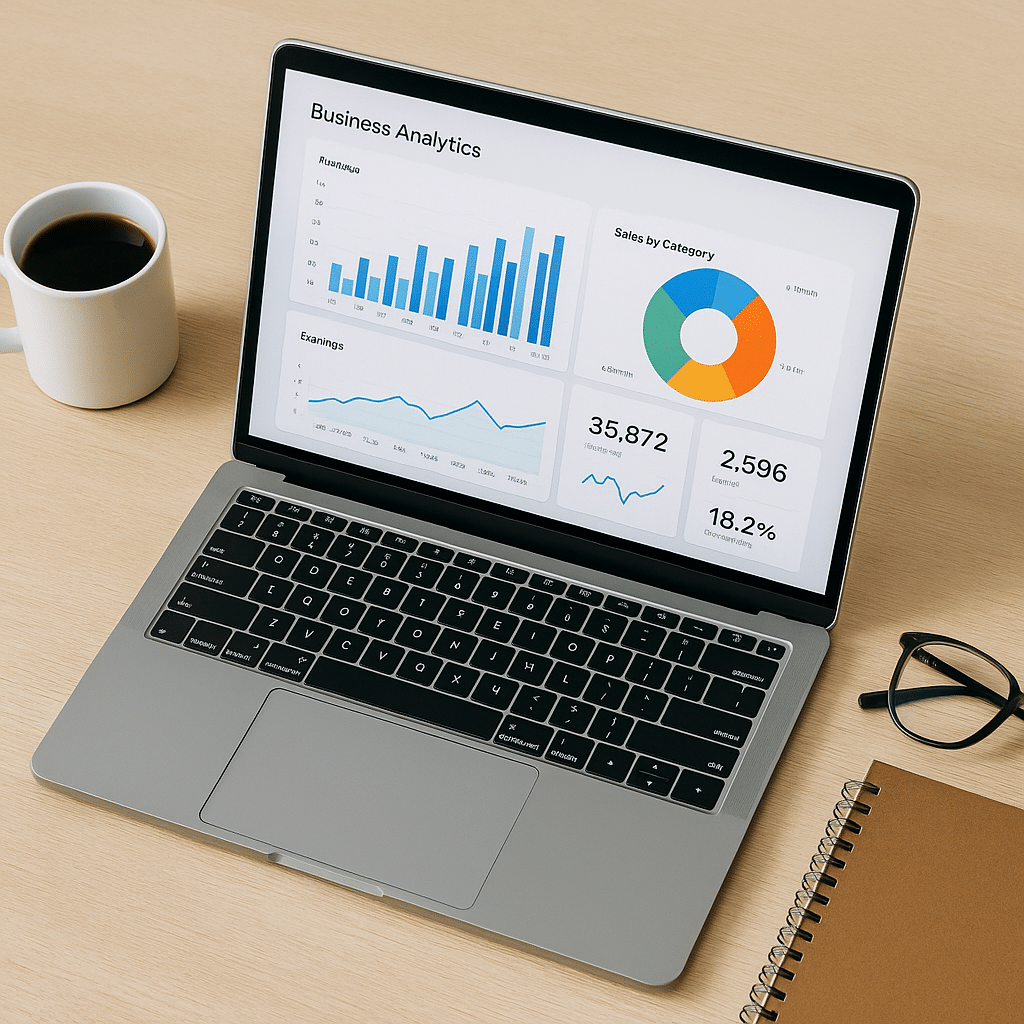

Many outsourced firms include access to dashboards, forecasting models, and integrations that unify financial and operational data. With connected systems, you don’t have to second-guess whether your numbers are accurate.

Internal capacity shifts toward insight

When your staff is relieved from repetitive tasks, they can spend more time analyzing and interpreting numbers rather than generating them. That shift unlocks more meaningful discussions about performance.

Scalable expertise during growth

As complexity increases – multiple revenue streams, international sales, ecommerce platforms – outsourced accounting provides access to controllers, fractional CFOs, and analytics teams who know how to design metrics that matter.

Improved forecasts and scenario planning

When data is accurate and current, projections become more reliable. Businesses can then plan for different growth or downturn scenarios with less guesswork and more confidence.

Common pitfalls to watch out for

Outsourcing can transform your business intelligence, but it’s not without risks if it’s approached casually. Several pitfalls tend to crop up when companies rush into outsourcing.

One common issue is failing to define the right KPIs up front. Without clarity on which numbers actually drive decisions – whether that’s customer acquisition cost, churn, or margin by product – you’ll simply get reports filled with data that may not be useful. Before handing over your books, decide on the handful of metrics that matter most.

Another pitfall is poor system integration. If your finance data lives in one platform, operations in another, and marketing somewhere else, outsourced reports can end up siloed. That disjointed picture makes it nearly impossible to trust business intelligence. The fix is to choose a provider who has a track record of tying together the systems you already rely on.

Timeliness is also a frequent stumbling block. Some businesses discover that outsourced books are accurate but consistently late, which means they’re making decisions on outdated numbers. Setting clear expectations for when the books will close and when reports are delivered is essential.

Over-customization can create its own problems. It’s tempting to ask for endless custom reports, but without discipline, you can end up with dozens of dashboards that no one actually uses. The smarter approach is to focus first on the critical reports that drive action, then build out more nuance over time.

Finally, incentives matter. If your provider is only focused on compliance, you may get clean books but not actionable insight. Make sure your agreement includes regular analysis and recommendations, not just financial statements. Outsourced accounting should support better intelligence, not just bookkeeping.

What “good” outsourced accounting for BI looks like

When done well, outsourced accounting creates a rhythm that drives decisions. You should expect a fixed cadence of financial reviews that go beyond “what the numbers were” to explain why they look that way and what comes next. Clean, well-designed dashboards should show not just profit and loss but also margin by customer, revenue by channel, and cash flow projections.

Scenario planning is another hallmark of good outsourced BI. Regular modeling of upside and downside cases gives leadership teams the ability to pivot quickly. Strong providers will also highlight margin drivers and cost breakdowns so you can see which parts of the business fuel growth and which parts drag on profitability. Perhaps most importantly, reports should arrive with enough speed that you can act on them before trends harden into problems.

Case in point: how BI reshapes strategy

Imagine an ecommerce company selling both branded goods and third-party dropshipped items. On the surface, revenue looks solid. But once outsourced accounting is in place, the company begins tracking margin by product line, fulfillment costs, and customer returns.

The analysis reveals that dropshipped products, while cheap to stock, generate far more returns and eat into margins. At the same time, certain ad channels bring in customers who tend to churn quickly, while others produce higher lifetime value. Armed with this insight, leadership shifts budget toward more profitable products and channels, trims inventory inefficiencies, and improves net margin without changing top-line revenue. That’s the power of business intelligence guided by outsourced accounting.

How to build the right partnership

To make outsourced accounting work for BI, the partnership has to be set up intentionally. Start by articulating the decisions you want to make with better data and the metrics that support those decisions. Evaluate providers not just on cost, but on their ability to deliver actionable dashboards and meaningful forecasts.

Onboarding should include cleaning up your chart of accounts and aligning your systems so data flows smoothly. From there, establish a clear reporting cadence and regular review meetings where insights are discussed, not just numbers delivered. Over time, iterate and add more detailed analysis as your business grows.

Take the Next Step

If you want clearer visibility into performance, stronger forecasts, and confidence in every decision you make, outsourced accounting can provide the business intelligence you’re missing. Fully Accountable specializes in turning financial data into actionable insight. Schedule a call today and let us design a tailored outsourced accounting solution that gives you the clarity and confidence to grow.